Woe the Australian Dollar!

If I warned them once, I warned them 1,000 times!

The Australian dollar (FXA) is going to fall.

That?s why I cautioned my Aussie friends to sell their homes, get the money the hell out of the country, and pay for their overseas vacations in advance.

As long as it is a de facto colony of China, the fortunes of the Land Down Under are completely tied to economic prospects there.

It is almost a waste of time looking at the Reserve Bank of Australia?s data releases. They have become a deep lagging, and really irrelevant indicators. You are better off going to the source, and that is in Beijing.

And therein lies the problem.

It is highly unlikely that the government in China has any idea what their economy is actually doing. Sure, they pump out the usual figures on a reliable basis like clockwork. These are educated guesses, at best.

Even in a perfect world, collecting numbers from 1.3 billion participants is a hopeless task. The US is unable to do these with any real accuracy, and we have one quarter of their population and vastly superior technology.

For what it is worth, Chinese President Xi Jinping has promised that his country?s GDP growth will not fall below a 6.5% annual rate for the next five years. At this pace, China is still creating more economic activity that any other country in the world.

Which leaves us nothing else to rely on but commodity prices to look at, far an away Australia?s largest earner. These are suggesting that the worst has yet to come.

Virtually the entire asset class hit new six year lows yesterday. I had to go to the weekly charts to see how ugly things really are.

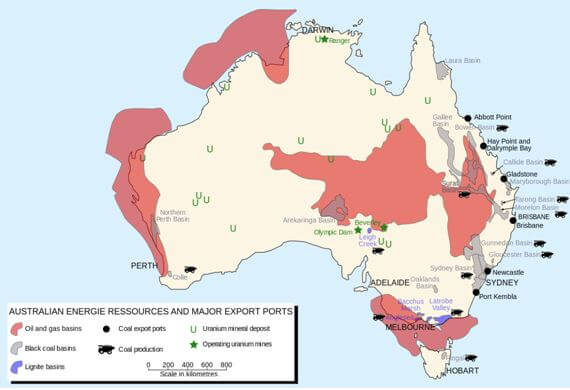

Australia?s largest exports are iron ore (26%, or $68.2 billion worth), coal (KOL) (16%), gold (GLD) (8.1%), and petroleum (USO) (5.7%). When the world?s largest consumer of these slows down, so does demand for these commodities.

BHP Billiton Ltd. (BHP), the largest producer of iron ore, has seen its shares plunge 57% from last year?s high.

But wait! It gets worse.

I have written at length about the transition of China from an industrial to a services based economy. You would expect this, as the Middle Kingdom has virtually no commodity resources of its own, but lots of smart people.

In a nutshell, they wish they had America?s economy. Where services now account for a staggering 68% of all economic activity.

This is why China?s future lies with Alibaba (BABA), Baidu (BIDU), and JD.com (JD). It does NOT lie with its steel factories and coalmines, which by the way, recently announced layoffs of 100,000, the largest in history.

To learn more about the structural remaking of China, please click here for ?End of the Commodities Super Cycle?.

There is one bright spot to mention. Australia is making a transition to a services based economy of its own. Tourism is rocketing, as is the influx of flight capital from the Middle Kingdom.

Walk the streets of Brisbane these days, and you are overwhelmed by the abundance of Asians coming here to learn English, attain a high education, or start a new business. When I came here 40 years ago, they were virtually absent.

How low is low?

It doesn?t help that the governor of the Reserve Bank of Australia, Australia?s central bank, Glenn Stevens, despises his nation?s currency.

He has used every rally this year to talk down the Aussie, threatening interest rate cuts and quantitative easing.

The hope is that a deep discount currency will allow the exporters to maintain some pricing edge on the commodities front.

The market chatter is that the Aussie will take a run as low as $0.55, the 2008-09 Great Recession low.

Whether we actually get that far or not is a coin toss.

And will even $0.55 below enough for Glenn Stevens?