Your Best Performing Asset Just Got Better

As most of my subscribers? know, I try to call all of them at least once a year and address their individual concerns.

Not only do I pick up some great information about regions, industries, businesses, and companies, I also learn how to rapidly evolve the Diary of a Mad Hedge Fund Trader service to best suit my voracious readers.

So when a gentleman asked me the other day to reveal to him the top performing asset of the next 30 years, I didn?t hesitate: your home. He was shocked.

I listed off the many reasons why residential housing is just entering a Golden Age that will drive prices up tenfold, if not 100-fold in the decades to come.

1) Demographics

This has been the hard decade for housing, when 80 million downsizing baby boomers unloaded their homes for greener pastures at retirement condos and assisted living facilities.

The 65 million Gen Xers who followed were not only far fewer in number, they earned much less, thanks to globalization and hyper accelerating technology.

All of this conspired to bring us a real estate crash that bottomed out in 2011.

During the 2020s, the demographics reverse. That?s when 85 million millennials start chasing the homes owned by 65 million Gen Xers. And, as they age, this group will be earning a lot more disposable income, thanks to a coming labor shortage.

2) Population Growth

If you think it's crowded now, you haven?t seen anything yet.

Over the next 30 years, the US population is expected to soar from 322 million today to 400 million. California alone will rocket from 38 million to 50 million.

That means housing for 78 million new Americans will have to come from somewhere. It sets up a classic supply/demand squeeze.

That?s why megaprojects like the San Francisco to Los Angeles bullet train, which may seem wasteful and insane today, might be totally viable by the time they are finished.

3) They?re Not Building Them Anymore

Or at least not as much as they used to.

In August, 2016, new home building delivered an annualized pace of a scant 609,000 new units, compared to a peak of 2 million a month prior to 2008. That means they are producing less than a third of peak levels.

The home building industry has to more than double just to meet current demand.

Builders blame regulations, zoning, the availability of buildable land, lack of financing, and labor shortages.

The reality is that the companies that survived the 2008 crash are a much more conservative bunch than they used to be. They are not looking for market share.

Instead, they are targeting a specific return on capital for their business, probably 20% a year pre tax.

It is no accident that new home builders like Lennar (LEN), Pulte Homes (PHM) and DR Horton (DHI) make a fortune when building into rising prices and restricted supply.

This strategy is creating a structural shortage of 5 million new homes in this decade alone.

4) The Rear View Mirror

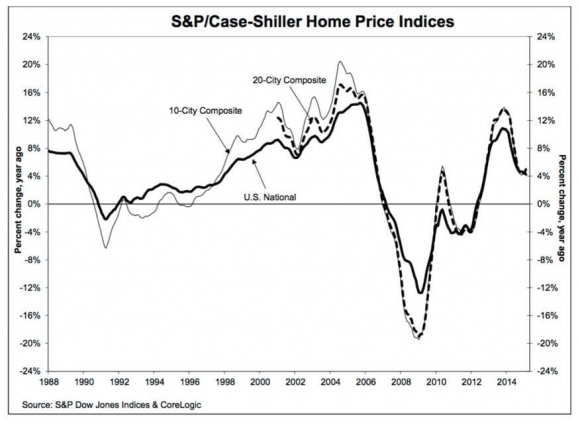

The S&P 500 Real Estate Price Index (see below) is currently running at an annual increase of 5.1%. Net out the many tax breaks that come with ownership, the real annual return is closer to 7%.

That beats cash at 0%, municipal bonds at 1.25%, US Treasury bonds at 1.55%, S&P 500 equities with dividends at 5%, and junk bonds at 5.5%.

Unless you have a new Internet start up percolating in your garage, it is going to be very hard to beat your own home?s return.

5) The Last Leverage Left

A typical down payment on a new home these days is 25%. That gives you leverage of 4:1. So in a market that is rising by 5.1% a year, your increase in home equity is really 20.4% a year.

Pay a higher interest rate, and down payments as low as 10% are possible, bringing your annual increase in home equity to an eye popping 51%.

There are very few traders who can make this kind of return, even during the most spectacular runaway bull market. And to earn this money on your house, all you have to do is sleep in it at night.

6) The Tax Breaks are Great

The mortgage interest on loans up to $1 million are deductible on your Form 1040, Schedule ?A?.

You can duck the capital gains entirely if the profit is less than $500,000, you?re married, and lived in the house for 2 years or more.?

Any gains above that are taxed at only a maximum 20% rate. These are the best tax breaks you can get anywhere without being a member of the 1%.

7) Job Growth is Good and Getting Better

The monthly Non Farm Payroll reports are averaging out at about 200,000 a month. As long as we maintain this level or higher, enough entry level homeowners are entering the market to keep prices rising.

And you know those much-maligned millennials? They are finally starting to have kids, need larger residences, and are turning from renting to buying.

8) There is No Overbuilding Anywhere

Never in the history of the industry have we been so far into an economic recovery, now seven years, without any sign of overbuilding.

You know those forests of cranes that blighted the landscape in 2006? They are nowhere to be seen, except in San Francisco.

The other signs of excess speculation:? liars' loans, artificially high appraisals, and rapid flipping are also nowhere to be seen.

No bubble means no crash. Prices should just continue grinding upwards in a very boring nonvolatile way.

9) Foreign Capital is Pouring In

Here in the San Francisco Bay Area stories abound of Chinese showing up with suitcases of cash and buying million-dollar homes.

The problem has become so endemic that the US Treasury is demanding proof of beneficial ownership on sales over $2 million to get behind shell companies and frustrate money laundering and tax evasion.

And with yields at 4.5%-6.5% in US commercial real estate, foreign institutions are pouring in tens of billions of dollars in capital. Remember, they are fleeing negative rates at home.

US real estate has become the world?s largest high yield asset class.

So the outlook is pretty rosy for individual home ownership for the foreseeable future.

Just don?t forget to sell by 2030.

That's when the next round of trouble begins.