Warren Buffett’s moves via Berkshire Hathaway (BRK.A) showed some telling signs this third quarter.

For one, the Oracle of Omaha has surprisingly trimmed his holdings in Apple (AAPL) and even JPMorgan Chase (JPM).

Another telltale sign that change is coming can be seen in his positions in biopharmaceutical titans.

Let’s take a closer look at one of the three biggest biopharma investments of Berkshire to date: Merck.

While the New Jersey-based pharmaceutical titan has not been as widely reported as its counterparts in the COVID-19 race, Merck has actually been working on a promising coronavirus program.

In fact, the company is part of the first five COVID-19 programs included in Donald Trump’s Operation Warp Speed.

Just last week, the company added another promising COVID-19 treatment to its pipeline via the $425 million cash acquisition of Oncolmmune—a move that would give Merck access to the privately-owned company’s COVID-19 treatment, called CD24Fc.

If successful, CD24Fc will be a powerful treatment for mild to severe cases of COVID-19.

To date, only Gilead Sciences’ (GILD) Veklury has received FDA approval and even that treatment failed to address all the health concerns.

In comparison, CD24Fc is expected to undergo a smooth sailing journey from clinical trials to its market launch in 2021.

Meanwhile, Merck may have another ace in the hole with its COVID-19 program.

While the company is already months behind the frontrunners, Merck has a competitive advantage over the COVID-19 vaccine candidates submitted by Pfizer (PFE), Moderna (MRNA), and even AstraZeneca (AZN).

Its experimental COVID-19 vaccine does not require any freezing.

This means that unlike the candidates of Pfizer and Moderna, Merck’s vaccine does not need ultra-special handling and transportation.

On top of that significant advantage, Merck has been working with the nonprofit organization International AIDS Vaccine Initiative to develop a COVID-19 vaccine that only requires a single dose.

In contrast, the leading candidates today require two shots of their vaccines to become effective.

Apart from betting big on its COVID-19 program, Merck is also upping the stakes in its oncology pipeline.

Its recent move is the $2.75 billion acquisition of VelosBio—a partnership that adds another potent arrow to Merck’s already powerful quiver of cancer drugs.

This deal with VelosBio provides Merck with access to cancer treatments under development. Most of these home in on the deadly cancer cells but manage to spare the patients from several horrible side effects.

Prior to this, Merck shelled out $1 billion to gain an equity stake in Seagen (SGEN). The deal also grants Merck access to an extensive antibody drugs pipeline.

Aside from its oncology-related acquisitions—all of which have been home runs for its investors—Merck’s existing cancer pipeline has been consistent moneymakers.

Apart from lung cancer treatment Keytruda, which generated a whopping $11.9 billion in sales in 2019 alone, Merck has a virtually unbeatable arsenal against cancer.

In fact, its thyroid cancer drug Lenvima, which was initially approved for thyroid cancer in 2015, already expanded its indications to cover renal cell carcinoma and potentially even melanoma, endometrial cancer, NSCLC, and bladder cancer.

This could bring Keytruda-like success for Merck in the future.

Aside from Merck, Warren Buffett also invested in biopharmaceutical titans Pfizer and AbbVie.

As of September, Berkshire Hathaway holds 3.7 million Pfizer shares, 21.3 million AbbVie shares, and 22.4 million Merck shares.

These moves are especially noteworthy since the company has not owned any of these biopharma giants at the end of June.

Looking at the profile of these companies, there is no obvious connection or theme.

As discussed, Merck is heavily investing in its oncology pipeline.

AbbVie has been busy diversifying and building a pipeline independent from its megablockbuster Humira.

In fact, this biopharmaceutical giant has delved into dermatology with its massive acquisition of Allergan, aka the Botox-maker.

Meanwhile, Pfizer has been in the news thanks to its COVID-19 vaccine.

Aside from its coronavirus program, Pfizer has been focused on completing the merger between its Upjohn unit and generic drugmaker Mylan (MYL) to form a new company, called Viatris.

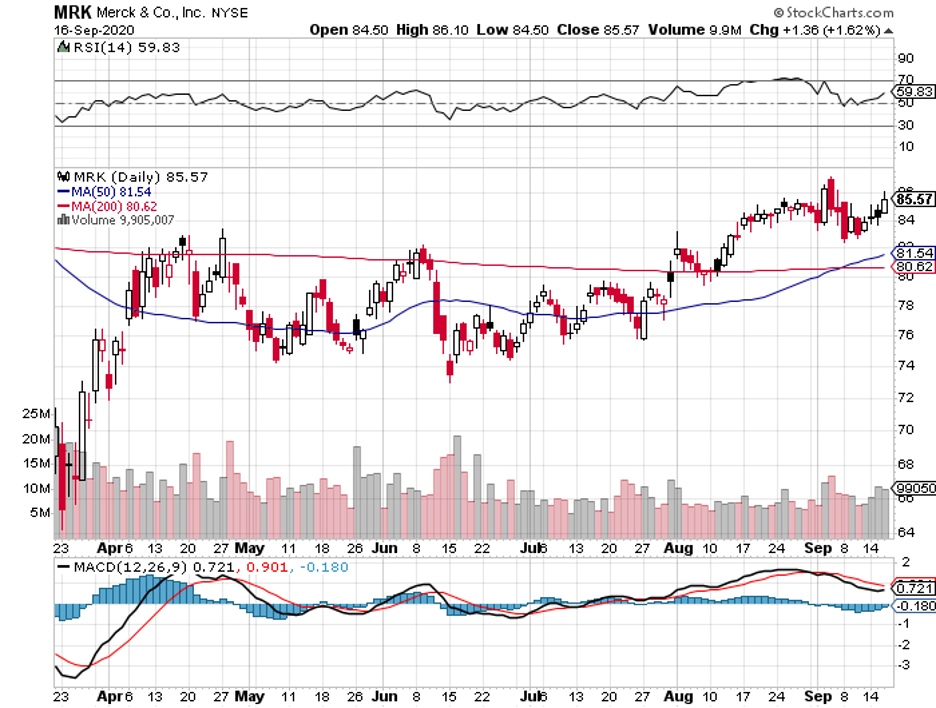

Analyzing all three closely though, one thing becomes clear: They are trading off their all-time highs and have been doing it for the entire 2020.

Do you know what that means?

Warren Buffett has been bargain shopping.