Biotechnology stocks have proven time and time again to be excellent growth vehicles for risk-tolerant investors.

Underscoring this claim are companies like COVID-19 vaccine frontrunner Novavax (NVAX), which generated jaw-dropping returns on capital for their investors within an impressively short period.

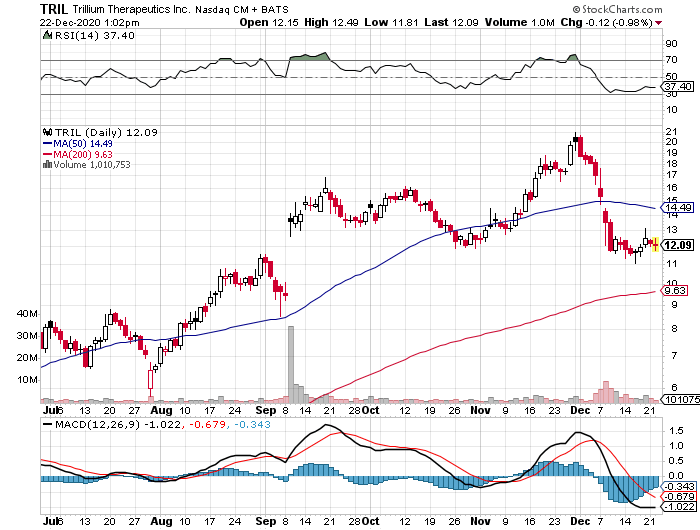

Now, another biotechnology stock is showing telltale signs of following their footsteps: Trillium Therapeutics (TRIL).

Trillium’s story is a familiar one in the biotechnology industry.

Trading only in the penny stock range back in 2019, the company’s share price practically quadrupled since the start of 2020.

Taking into consideration that this meteoric rise actually happened while COVID-19 was blasting the world to smithereens, it’s hardly surprising that this news didn’t receive much media attention.

Trillium’s shares are currently up by an astounding 1,260% -- and the company still has so much room to grow from here.

For context, Trillium had a market capitalization of $7 million in November 2019. This number skyrocketed to $1.3 billion since its shift to cancer technology.

Although a lot of factors came into play, the key turning point for Trillium was when the company decided to go all-in on its cancer programs.

Ultimately, Trillium’s goal is to challenge chemotherapy.

The move to shutter its lead programs on tumor treatments and instead focus on developing cancer-fighting technology was the gamble of a lifetime for the company.

This gutsy move impressed investors, and Trillium was never the same since then.

Today, Trillium is the No. 1 stock on Canada’s S&P/TSX Composite Index, overtaking its previous leader e-commerce giant Shopify (SHOP) by almost 10-fold.

In the US, Trillium shares rank as the No. 4 best-performing company on the Nasdaq Composite Index.

While its epic stock market rally may have some investors feeling left out, all signs point to further gains in the future even for those who missed the initial boom.

Among the major capitalists of this biotechnology company is giant biopharmaceutical company and COVID-19 vaccine leader Pfizer (PFE), which invested $25 million in Trillium’s common stock.

While this equity stake may seem small in relation to Pfizer’s $212.16 billion market capitalization, this initial show of confidence is hailed as a prelude to an even bigger investment in the future.

So far, the most exciting cancer treatments in Trillium’s pipeline are TTI-621 and TTI-622.

These programs are in the same class of emerging cancer technologies, called CD47-based therapies, that prompted Gilead Sciences’ (GILD) $4.9 billion acquisition of Forty Seven, Inc. in April this year.

Aside from Gilead, AbbVie (ABBV) has also been reported to have invested a huge sum in this technology.

In simplest terms, CD47-based therapies can bypass the “don’t eat me signal” put up by some cancer cells in an effort to evade immune detection.

Thus far, both TTI-621 and TTI-622 have been showing promising results. Trillium recently announced that it will increase the dosage in these programs.

While Trillium leaders have not been specific in terms of being open to an acquisition, their recent statements indicate that they are not completely opposed to one.

It’s either that or a partnership with a company as big or even bigger than Pfizer.

As with all the biotechnology stocks, however, there will always be a risk.

For Trillium, the most evident one is competition.

While it’s true that the company has been recognized as the leader in the CD47 arena, more and more competitors are entering the immuno-oncology space.

Right now, the most obvious rival is Gilead, which added Immunomedics (IMMU) to its arsenal via a $21 billion acquisition deal.

Given the sheer amount of money that Gilead has been spending to practically corner the immuno-oncology market, it’s to be expected that more biopharmaceutical titans will enter the fray.

This is one of the reasons Trillium has been tagged as a prime candidate for a massive acquisition deal soon. So far, Pfizer is considered the most probable suitor.

Despite its astonishing performance this year, Trillium’s market capitalization still remains within the small-cap territory. That’s to be expected since its lead assets are still undergoing trials.

Considering that it is an early-stage biotechnology stock, Trillium does not have much in terms of income.

However, the company does have enough cash to last for a while. At the moment, it has $130 million cash.

With its total expenses of $38.8 million in 2019, I say this could offer the company more than three years of breathing room financially.

But it would be shocking if Trillium’s value won’t enter the large-cap territory (higher than $10 billion) if and when the company’s high-value assets reach the late-stage studies.

The fact that it’s also an attractive acquisition candidate offers incredible incentive to its investors.

Simply put, Trillium’s stock could get as much as 1,000% gain over the coming two to three years, making it an ideal investment for risk-tolerant investors.